Even if you guard that critical 9-digit number carefully, you can still have a fraudulent tax return filed using it.

Your first thoughts when you become the victim of a tax identity thief might go along the lines of:

- Did I click on a link in an email that I shouldn’t have?

- Is my virus protection not strong enough?

- Was there a breach on my software developer’s servers, or on those of my tax preparer?

- Should I have entered my Social Security number on a non-tax-related site?

Then the creepy feelings of having been invaded kick in, and you can’t decide what to do first.

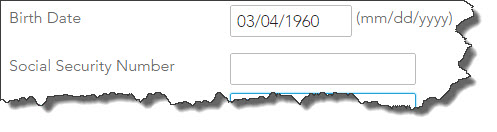

Figure 1: Tax identity theft occurs in numerous ways, and it may well have nothing to do with a previous tax filing of yours.

Tax identity theft simply means that someone got your Social Security number and filed a fraudulent return with it, claiming a refund. You would probably find out about it when you got a letter from the IRS stating that your Social Security number was used to file more than one return. Or you owe more tax than you thought you did. Or a return came in using your Social Security number, claiming wages from an employer who wasn’t yours.

How did they get your number? Forbes lists 10 ways it can happen. Basically, anyone who works for an employer who has your sensitive personal information of yours can use it or sell it.

How did they get your number? Forbes lists 10 ways it can happen. Basically, anyone who works for an employer who has your sensitive personal information of yours can use it or sell it.

The FTC recommends several steps you can take to avoid being a victim of tax identity theft, including:

- Don’t carry anything with you that has your Social Security number on it.

- If you must provide your number to anyone but the IRS, ask how they are going to keep it safe.

- Take outgoing mail to a U.S. Post Office location, and try not to let your incoming mail sit in your box for a prolonged time.

- Shred, shred, shred.

Online tax identity theft can also be the culprit, so stay as safe as you can there, too. Many websites insist on complex passwords and suggest you change them occasionally. Ideally, you should do this for any site that requires a password, especially anything that contains personal and/or financial information. Keep track on your passwords on paper instead of a computer program that stores them.

When you dispose of desktop hardware and mobile devices, use utility software and/or check your owner’s manual for information on how to delete all information.

Never send your Social Security number, site passwords, account numbers, or similar information to anyone in an email message. Pick up the phone instead. And keep tax identity theft in mind anytime you post something on social media.

If tax identity theft should happen to you, the IRS suggests several steps to take, including:

- Respond to the IRS’s letter immediately.

- Contact law enforcement. You’re the victim of a crime.

- Get a “fraud alert” placed on your credit records by contacting Equifax, Experian, or TransUnion.

- Let all your financial institutions know about the breach.

- Tell us about it. We can help you with your next steps, especially where tax-filing is concerned.

- Report it on the FTC website.

How long will it take to clear your record? That depends on a number of things. But you can try to minimize the damage by reporting the situation quickly.